Actis llp a private equity investment firm is planning to invest usd 500 million into its 2nd renewable energy platform in india solenergi power pvt ltd.

Private equity investing in solar energy india.

Frv won the 135 mw project in an auction by solar energy corporation of india seci back in 2016 with a bid of inr 4 43 per kwh.

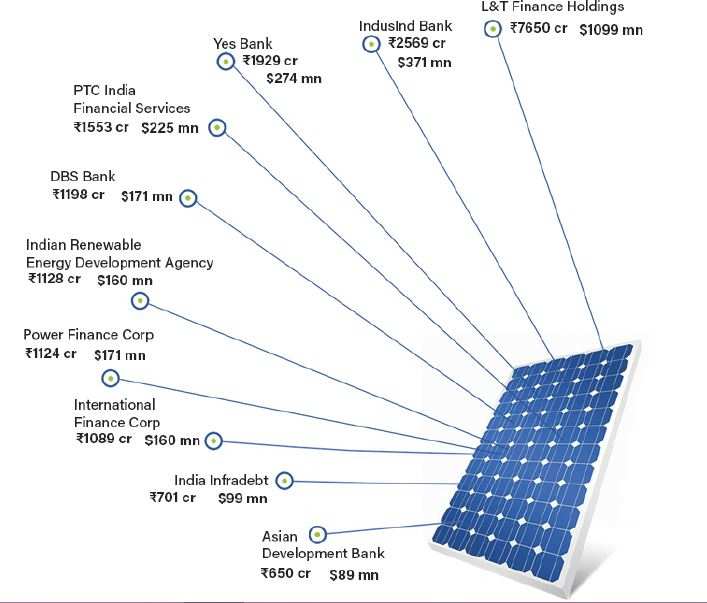

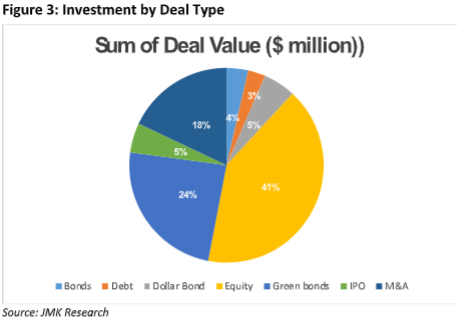

Investments in both debt and equity.

Solar investors are a varied group including.

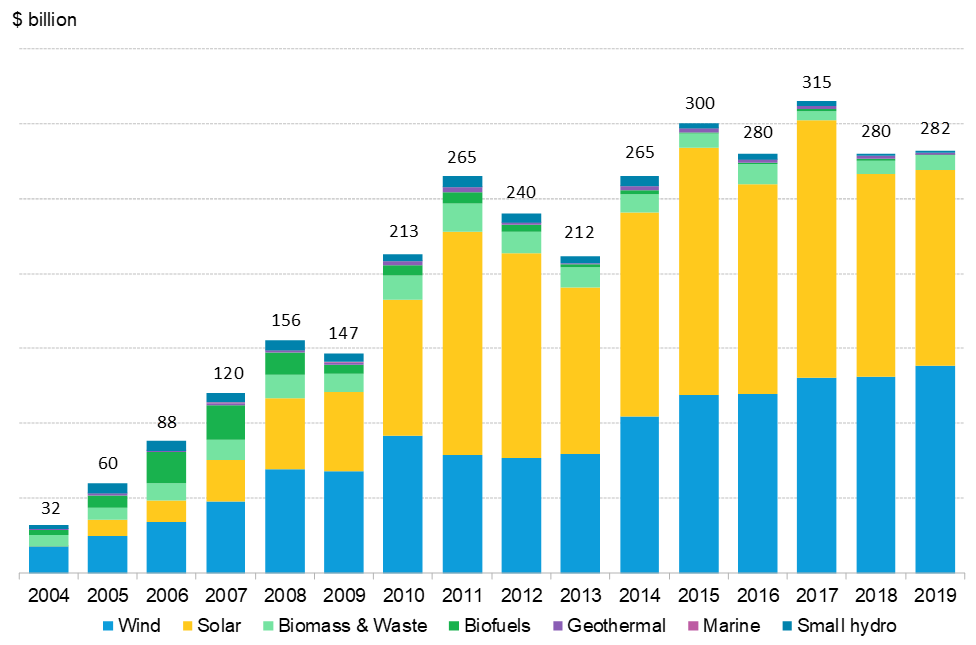

Private equity and venture capital has been one of the biggest sources of funds for financing renewable energy projects in india particularly wind and solar power projects.

The global vc funding venture capital private equity and corporate venture capital in the solar sector was 13 per cent higher at 1 billion in the first nine months of 2019 compared to 889.

Singapore s gic private limited is the largest shareholder in greenko owning a 65 ownership stake.

The private equity arms of goldman sachs jp morgan and morgan stanley have also.

Japanese corporation are keen on renewable energy companies in asia.

Total investments by pe vc investors in the segment in india was estimate.

Tokyo based orix corporation plans to invest us 980 million in hyderabad based greenko energy holdings for an estimated 20 stake.

That is being leapfrogged and changed massively with rooftop power solar energy locally generated wind.

Why one private equity firm is betting big on impact investing in renewable energy.

Greenko energy is a wind and solar developer in india.

Nalfx seeks to provide long term capital appreciation by investing at least 25 of its total net assets under normal market conditions in equity securities of alternative energy companies.

A 47 increase in india s wind and solar power private equity investments from january 2017 to september 2017 to usd 920 million from a total of nine investment deals.

Most solar investments take place in china the us being the 2 nd market followed by japan india and germany.

Of course we bring the full capital stack sponsor equity tax equity and debt too.

Landscape of solar investors.

The list includes singapore based gic holdings abu dhabi investment authority softbank brookfield cppib and cpdq from canada orix japan sembcorp and apg holland among others all of whom have decided to invest in the india renewables growth story.